California Paid Sick Leave

Entitlement:

- An employee who, on or after July 1, 2015, works in California for 30 or more days within a year from the beginning of employment is entitled to paid sick leave.

- Paid sick leave accrues at the rate of one hour per every 30 hours worked, paid at the employee’s regular wage rate. Accrual shall begin on the first day of employment or July 1, 2015, whichever is later.

- Accrued paid sick leave shall carry over to the following year of employment and may be capped at 48 hours or 6 days. However, subject to specified conditions, if an employer has a paid sick leave, paid leave or paid time off policy (PTO) that provides no less than 24 hours or three days of paid leave or paid time off, no accrual or carry over is required if the full amount of leave is received at the beginning of each year in accordance with the policy.

Usage:

- An employee may use accrued paid sick days beginning on the 90th day of employment.

- An employer shall provide paid sick days upon the oral or written request of an employee for themselves or a family member for the diagnosis, care or treatment of an existing health condition or preventive care, or specified purposes for an employee who is a victim of domestic violence, sexual assault, or stalking.

- An employer may limit the use of paid sick days to 24 hours or three days in each year of employment.

How to set up Sick Leave in BAS or GrowPoint:

First of all, you must decide if you will be complying by the Accrual method or the Annual method. Either method, you will setup the Earnings Type as noted below through number 4.

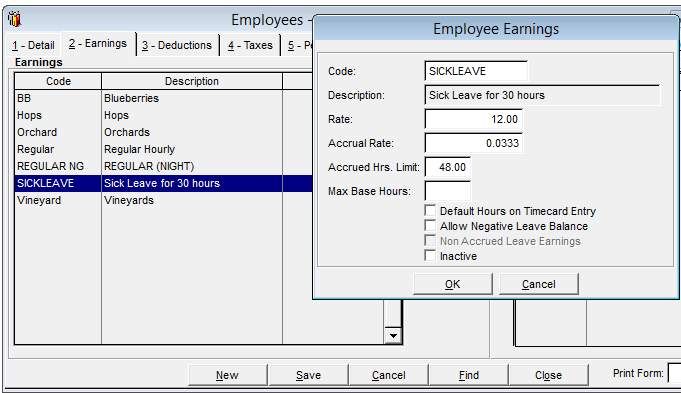

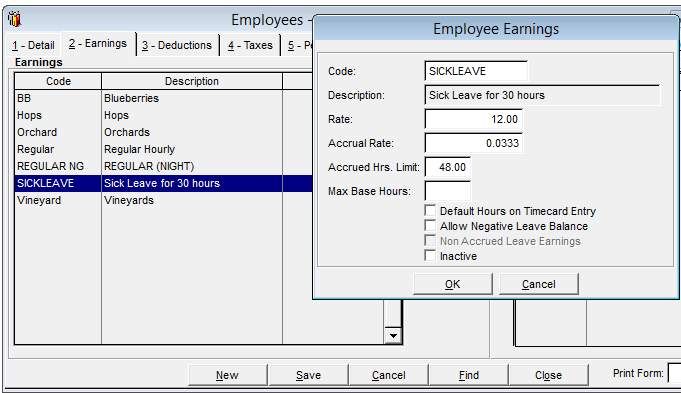

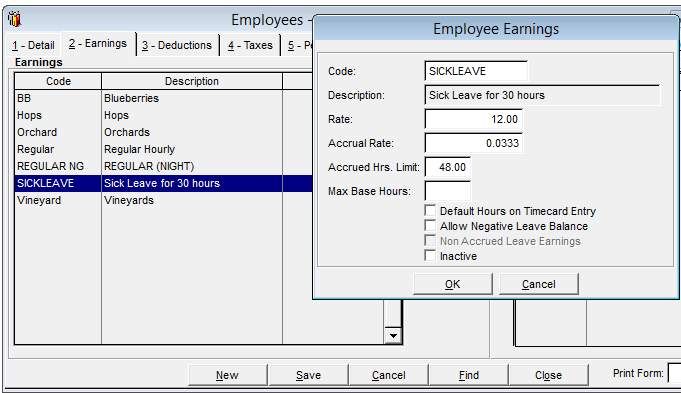

- 1. Create a new Earnings Type which will be a “Leave” type as noted by checking the box in the upper right to make it a “Leave”.

- 2. Give it a code and description of your choice, but make it taxable pay and Hourly.

- 3. You will add the rate on the Employee earnings type but you can put in a rate of minimum wage here if you like, as a default.

- 4. Decide whether it needs to default on all employees, if so check Employee Default.

- 5. If you are using the Accrual method, after checking the “Leave” box enter the rate of .0333 to designate an accrual of 1 hour per 30 hours and a limit of 48 hours total accrued (2 years). Do Not check the Accrual Dollars or Accrual by Period since you are accruing by the hour. If you check Allow Negative Leave Balance that will allow you to pay out more than they have accrued. That is your choice.

- 6. Next, add the earnings type to the employee and on the earnings tab there, also put in the .0333 rate and the 48 hour limit if you are using the Accrual method.

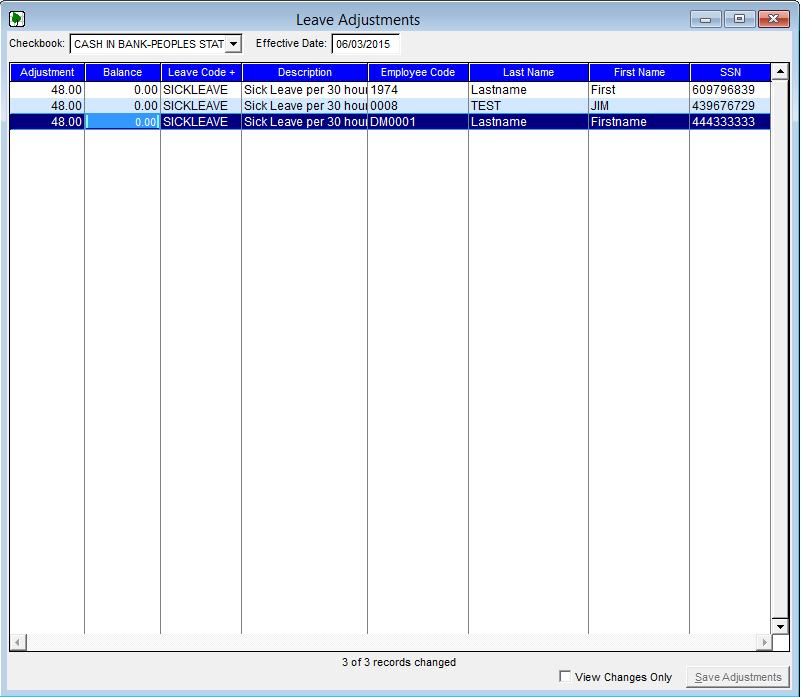

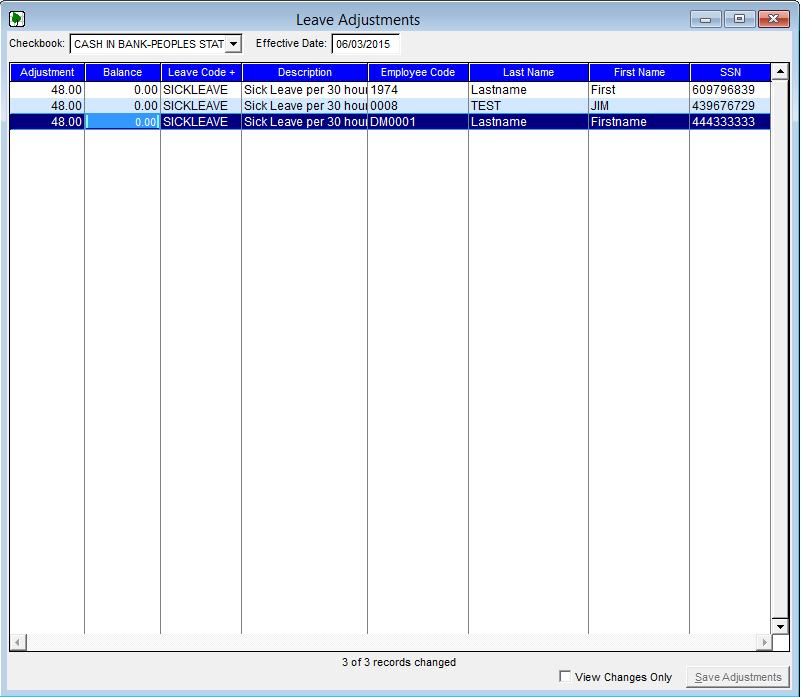

If you are using the Annual method, do not enter an accrual rate on the setup, but save the earnings type and add it to the employee. Then go to Utilities and use our Leave Adjustment utility to give everyone 24 hours at the beginning of the year. On the Annual method you do not have to accrue or rollover.

At pay-out time, just use the Sick Leave earnings type on the timecard for the hours taken.